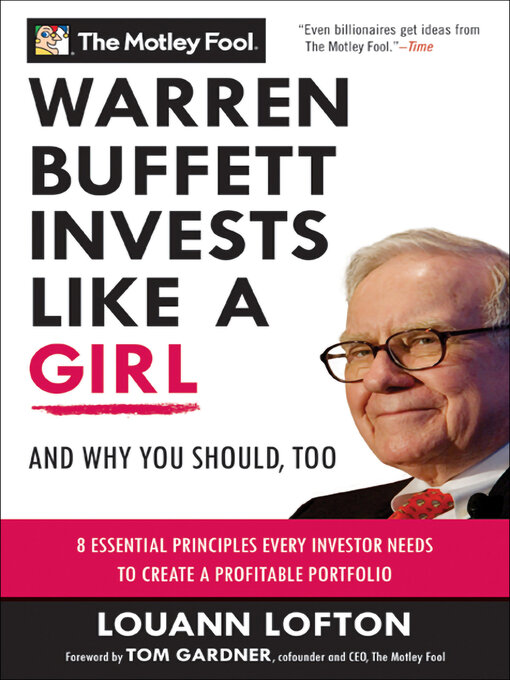

*** Wall Street Journal bestseller ***

Investing isn’t a man’s world anymore—and this provocative and enlightening book shows why that’s a good thing for Wall Street, the global financial system, and your own personal portfolio.

Warren Buffett and all of the women of the world have one thing in common: They are better investors than the average man. It’s been proved by psychologists and scientists, and the market calamities of the past two years have only provided more statistical and anecdotal evidence of the same. Here are just a few characteristics of female investors that distinguish them from their male counterparts.

• Women spend more time researching their investment choices than men do. This prevents them from chasing “hot” tips and trading on whims — behavior that tends to weaken men’s portfolios.

• Men trade 45% more often than women do, and although men are more confident investors, they tend to be overconfident. By trading more often — and without enough research — men reduce their net returns. But by trading less often, women get better returns and also save on transaction costs and capital gains taxes.

• A study by the University of California at Davis found that women’s portfolios gained 1.4% more than men’s portfolios did. What’s more, single women did even better than single men, with 2.3% greater gains.

• Women tend to look at more than just numbers when deciding whether to invest in a company. They invest in companies they feel good about ethically and personally. And companies with good products, good services, and ethics tend to have better long-term prospects — and face fewer lawsuits.

Women, with their capability for patience and good decision-making, epitomize the Foolish investment philosophy and the investment practices of the most successful investor in history: Warren Buffett. While men are brash, compulsive, and overly daring, women tend to be more studious, skeptical, and reasonable. This indispensable volume from the multimedia financial education company Motley Fool offers essential advice for every investor hoping to turn today’s savings into wealth for a better tomorrow.